One of the most electrifying moments of entrepreneurship is when the initial business idea strikes. Your mind conjures up all the possibilities as you begin to turn that flicker of an idea into a full-fledged flame. Deciding to launch your business is a thrilling milestone, but with it comes some careful planning and decision-making. One of the early decisions you’ll need to make before officially going into business is how you’re choosing the right business entity for your company.

In the simplest terms, a business entity is how you structure your business. It’s a vital step to managing the operation of your new venture. Your chosen entity — be it a sole proprietorship, LLC, partnership, or corporation — sets the stage for taxes, legal protection, and growth. It’s the puzzle frame that holds everything together, guiding your entrepreneurial journey. It can feel like a maze, but I’ve written this guide to share why I opted for an LLC and shed light on the other business entities to consider, so you can find the best structure to match your needs and goals.

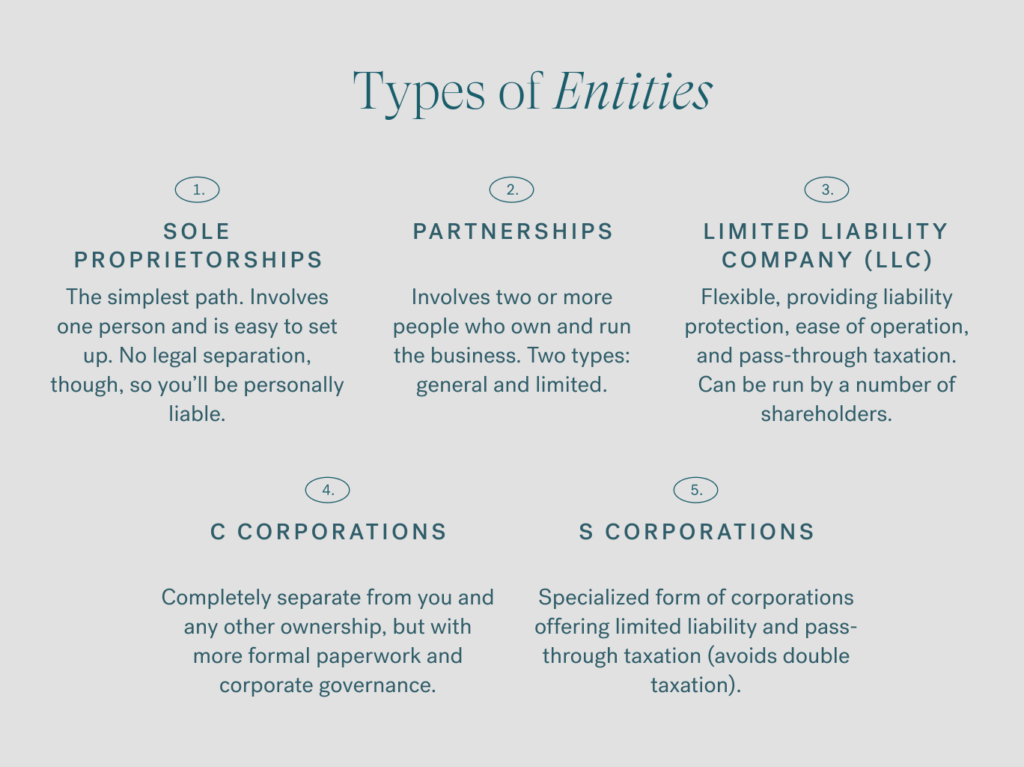

A Simple Snapshot of Different Business Entities

Business entities have different tax reporting nuances, equity shareholder structures, and compliance & liability considerations. Let’s dive into some pros and cons of business entity structures aspiring entrepreneurs should know:

Sole Proprietorships: Your Personal Venture

Do you have that one-of-a-kind idea that keeps you awake at night? (A jewelry maker or freelance graphic designer are good examples.) A sole proprietorship might be your starting point. Here’s the lowdown:

What is it?: The simplest form of business, where you and your business are one entity.

Pros: You have complete control, a quick setup, minimal fees, and straightforward tax reporting.

Cons: You’re personally liable for debts, losses, and other liabilities (i.e. if someone sues your company); legal separation between you and your company is non-existent or difficult to prove.

Partnerships: The Power of Shared Dreams

Partnerships may work best for you if teaming up with fellow visionaries feels aligned. A law firm founded by two attorneys may fall under this category.

What is it?: Business owned and operated by two or more people in collaboration.

Pros: Shared expertise, knowledge, and costs; a good consideration for friends, family, or partners.

Cons: Shared responsibilities mean shared victories and challenges. Conflict resolution skills are a must, especially when disagreement inevitably occurs.

Limited Liability Company (LLC): Flexibility with Protection

When I launched my business as a sole founder, I opted for an LLC structure. . LLCs are flexible, well-established entities that separate individuals from their businesses. Google is an LLC, while its parent company, Alphabet, is a corporation.

What is it?: A separate legal entity from the owner, offering personal liability protection.

Pros: Enjoy pass-through taxation, personal liability protection, and operational ease due to its commonality.

Cons: Operating agreements can be complex; formalities are involved.

Corporations: The Big Leagues

Corporations might be the right move if you have specific plans for how you plan to fundraise and eventually exit your business. Major companies like Apple and Amazon are structured as corporations.

What is it?: An entity completely separate from owners; can sell ownership through stock.

Pros: Limited liability, ability to raise funds aggressively, and potential for IPO.

Cons: Formal paperwork, corporate governance, and subject to corporate taxes.

Here’s a closer look at the two types of corporations:

• C Corporations: All income and losses are the corporation’s responsibility. Also subject to corporate taxes.

• S Corporations: A specialized version of corporations, perfect for those seeking the best of both worlds — limited liability and pass-through taxation (avoids the issue of double taxation).

Whether you’re dreaming of a simple sole proprietorship, a dynamic partnership, the flexibility of an LLC, or the prestige of a corporation, remember this: Your business entity is like a tailored suit — it should fit you perfectly. Each entity type has pros and cons, so pick what resonates with your goals and ambitions.

Why I Chose an LLC

Let’s talk about my personal choice — the Limited Liability Company (LLC). When I started my company, I was the only founder and had no institutional investors, so the capitalization structure was very simple as the structure only consisted of me. My tax accountant advised that given my simple capital structure and desire for limited liability, flexibility and simplicity, forming an LLC was an appropriate option for my business needs. Three of the top benefits of forming an LLC are:

The Straightforward Setup

LLCs are common and can be set up easily online depending on your business state’s rules and restrictions. Fees are generally low and annually renewed.

Limited Liability Protection

My assets are shielded if I face business-related issues like certain debts or legal issues because an LLC is considered separate from the individual managing the business.

Pass-Through Taxation

I avoid double taxation (paying taxes on the company profits and then paying personal taxes on any distributions you receive) because, with an LLC, the company’s income passes through to your personal tax return.

Navigating the Waters of Decision

So, how do you decide on the right business entity for your venture? Just as you’ve honed your skills in understanding and handling challenges at any point in your entrepreneurial journey, you can approach this choice strategically. Consider these four compass points — each serving as a guiding light to steer you through the complexities of making this important decision.

1. Costs and Complexity

Consider setup expenses and how challenging it might be to manage different business structures. Each comes with its costs and demands that require varying efforts.

2. Compliance and Reporting

Stick to rules and regulations smoothly. Choose an entity that aligns with how much paperwork and compliance work you’re comfortable handling, especially if you cannot outsource this service to an employee, partner, or third-party company.

3. Tax Implications

Be mindful of tax implications. Understand how each entity type affects your business and personal taxes.

4. Future Growth

Think ahead and envision your business’s growth. Certain entities suit different growth plans. Some structures are easier to transition from than others. Consult with a professional to appropriately navigate any future changes you may need to make to your entity type.

Championing Your Entrepreneurial Future

Ultimately, it’s about feeling secure in your choice. For me, understanding the liability protections of an LLC was a game-changer. It assures me that my personal assets remain untouched even if the business hits a rough patch. The tax advantage is a sweet bonus, too — business income and distributions are intertwined and taxed as a pass-through against my personal income, making taxation simpler and not subject to double taxation.

As you start choosing the right business entity for you, remember to go for a structure that will nourish the foundation of your business and entrepreneurial spirit. Take your time, seek advice, and let your business entity become a true reflection of your aspirations.

\Get grant opportunities, exclusive invites, tools, and entrepreneurial inspiration in your inbox once a month. Sign up for the Makers Mindset newsletter.