Let’s dive into a topic that’s as important as crafting the right business plan: your credit score. I’ve come to understand the profound impact this number can have on a business journey, especially when you’re first starting out and may need to lean on credit cards or bank loans to make ends meet. Mastering your credit score is more than just a financial metric; it’s a reflection of your financial history and can play a significant role in your entrepreneurial success.

The Fundamentals of Credit for Entrepreneurs: Personal Credit vs. Business Credit

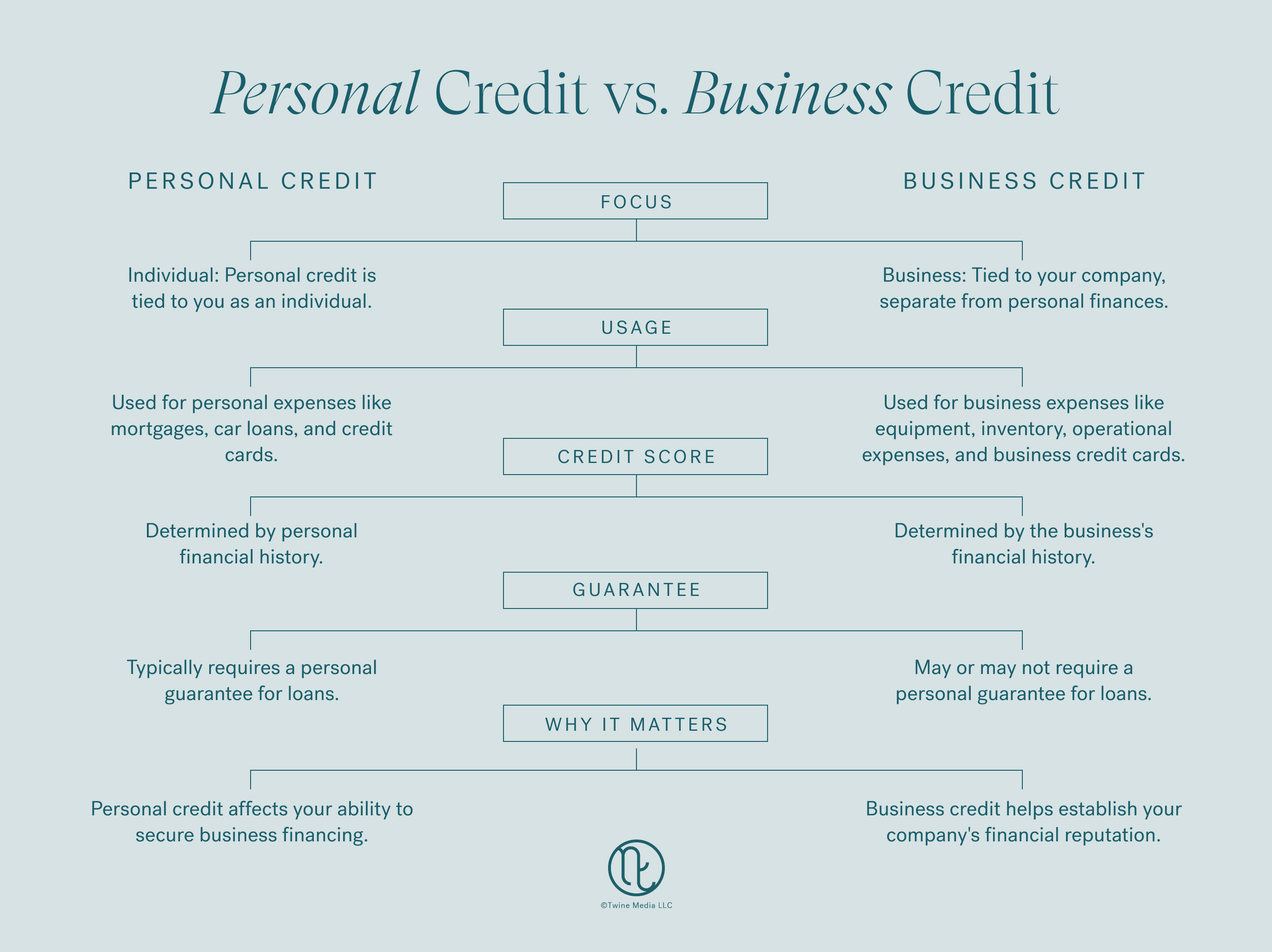

Your personal credit score serves as a mirror reflecting your financial past – the highs, the lows, and everything in between. In contrast, business credit resembles a ledger, documenting your company’s financial adventures. It is separate yet closely connected with your personal credit.

When I was laying the groundwork for Briogeo, my personal credit played a pivotal role, guiding lenders and banks toward placing their trust in my vision. Your personal and business histories often influence each other significantly and understanding how these two credit realms work together is fundamental for navigating the entrepreneurial landscape.

Your personal credit score can significantly affect your ability to secure business financing. Your early financial habits, whether cautious or daring, play a substantial role in shaping your business’s creditworthiness as your venture grows. Over time, you may find yourself transitioning from personal guarantees to establishing a distinct business credit history.

The Impact of Personal Credit on Your Business Journey

In the early stages, your personal credit serves as a pivotal first impression. It dictates the ease with which you can access funds, negotiate terms, and gain higher credit card spending limits as you scale your business. This is especially important if you are bootstrapping your business.

Personal Credit as a Business Foundation

In the beginning, securing financial backing often means putting your personal credit score on the line. Lenders and investors use it as a lens through which they view your business. A strong personal credit score can open doors, while a less favorable one might prompt more cautious lenders.

Navigating Credit Decisions as Your Business Grows

Growth in business often comes hand-in-hand with more complex financial decisions. Here, your personal credit doesn’t just fade into the background. Instead, it evolves, playing a vital role in enabling your business to grow. Understanding and leveraging this dynamic as you scale is essential.

Balancing Growth and Credit Health

As your business expands, maintaining a healthy personal credit score becomes a strategic imperative. The currents of business can be turbulent, and a steady personal credit score acts as your navigational compass. The ability to negotiate favorable terms and secure necessary funding hinges on your credit’s strength. It’s about striking the right balance between personal and business financial health.

Practical Tips for Mastering Your Credit Score

Navigating the world of credit scores doesn’t have to be a daunting labyrinth. Here are some actionable strategies that have served me well:

Timely Bill Payments

Pay your bills on time, every time. This demonstrates reliability to lenders and maintains the harmony of your credit score.

Smart Credit Utilization

While it may be tempting to max out your available credit, restraint is key. Aim to use a modest portion of your available credit (less than 30%) on average, understanding there may be months that require heavier utilization.

Regular Credit Report Checks

Monitor your credit report regularly using your bank’s tools or sites like Credit Karma. Identify and address issues promptly. It’s about staying proactive, not reactive.

Thoughtful Credit Applications

Each new application can impact your score, so consider them carefully. Prioritize quality over quantity when seeking new credit opportunities.

With a strong personal credit score, you’re not just a borrower; you’re a sought-after client. This stature can give you leverage in securing favorable terms and access to broader financial resources. But it’s a delicate balance, one that requires careful planning and foresight. Navigating the negotiation process with lenders becomes a crucial skill.

The Role of Personal Credit in Future Ventures:

Whether you’re eyeing new horizons or contemplating additional business ventures, your personal credit will play a role. It’s important to ensure that your credit score is in tune for future financial needs, especially the inevitable challenging moments. It’s about proactive planning to ensure that the next chapter in your entrepreneurial journey is met with financial readiness.

Your personal credit score is not just a number – it’s a key player in your entrepreneurial journey, influencing everything from funding opportunities to business growth. Managing your credit is essential and can help lay the foundation for successful business endeavors.

Get grant opportunities, exclusive invites, tools, and entrepreneurial inspiration in your inbox once a month. Sign up for the Makers Mindset newsletter.