Embarking on the journey of building your business comes with an array of decisions, each one a stepping stone toward your success. One of the pivotal crossroads you’ll face is the question of whether to bootstrap your business or seek external funding. Bootstrapping — or self-funding your business — involves the use of your own money (or credit cards) to finance its growth, instead of seeking loans or investors.

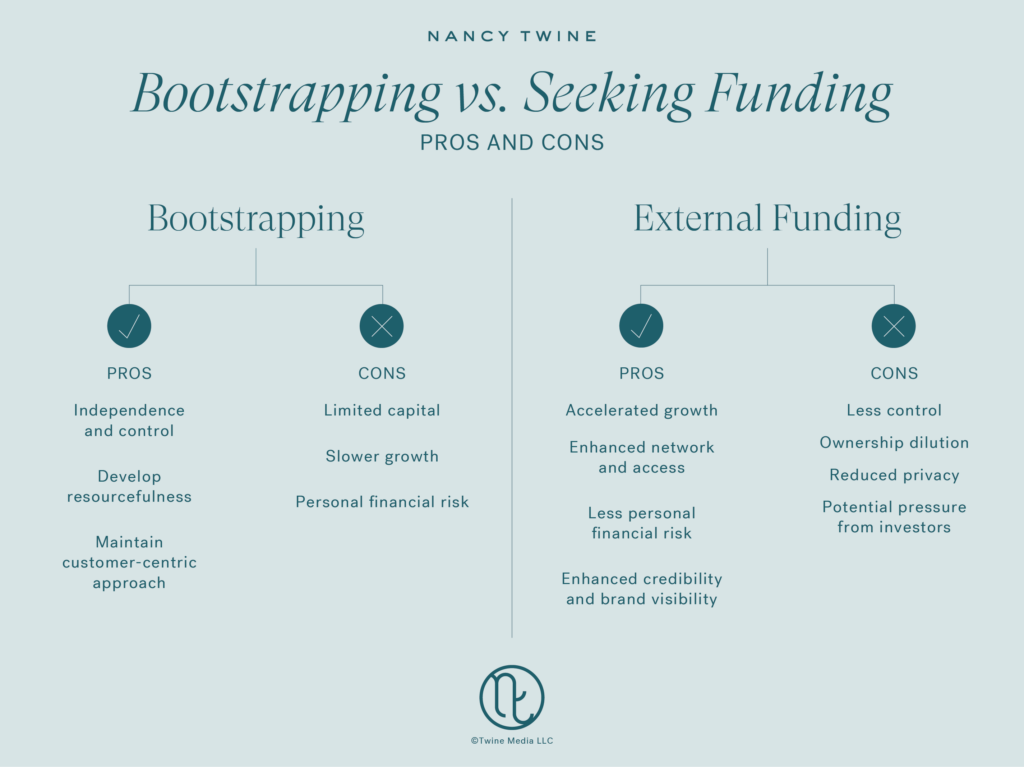

When you face this important decision, you might find yourself wondering which approach fits best with your vision and circumstances. As an entrepreneur who’s experienced both sides of the bootstrapping vs. seeking funding coin, I’ve learned some important lessons along the way. So, let’s delve into the pros and cons of bootstrapping vs. seeking funding.

The Power of Bootstrapping: What to Expect When You Self-Fund Your Business

Bootstrapping is a popular approach for many entrepreneurs, with even giants like Apple and Meta choosing to bootstrap in their early days. I also chose this approach when I started Briogeo.

“Bootstrapping let me maintain complete control and flexibility in decision-making. It forced me to think creatively, make strategic choices, and focus on delivering value to my customers.” – Nancy Twine

What are the main advantages to bootstrapping?

1. You have more independence and control over your business

When you fund your business yourself, you answer only to yourself. The evolution of your business is completely in your hands, which means you can stay true to your personal vision.

2. You become more financially disciplined and resourceful

With your own money on the line, you’ll learn to get creative. During the early days of Briogeo, I found myself needing more support but wasn’t ready to hire full-time employees. By bringing on part-time consultants and freelancers, I was able to minimize costs and maximize everyone’s time.

3. You build a more customer-centric approach

Self-funding nurtures a relentless focus on delivering value to your customers. This dedication to your customers will help you build a foundation of loyal clients who appreciate your personalized attention.

Bootstrapping will offer you flexibility, autonomy, limited external pressures, and the financial discipline necessary to build a resilient business capable of weathering changing circumstances. However, as an entrepreneur, it’s important to also be realistic about the challenges you might face.

What are the potential cons to bootstrapping your business?

1. Your capital might be limited at the outset

Self-funding your business may mean starting with limited funds. With finite financial resources, you might find yourself unable to scale your business as quickly as you’d like.

2. Your business may grow more slowly

Since you’ll be relying solely on your personal investments and the revenue you generate, growth may take longer.

3. Your personal finances are on the line

By definition, bootstrapping means investing your personal finances in your business, which can be risky.

Expanding Your Horizons with External Capital: What to Expect When You Seek Funding for Your Small Business

The alternative to bootstrapping your business is seeking external funding, which means securing loans or investors. While some entrepreneurs choose to seek funding at the outset, many others decide to seek funding after a period of bootstrapping. After six years of bootstrapping Briogeo (and using bank loans), my business was growing rapidly. At this point, I decided to bring on a private-equity investor.

“Seeking funding allowed me to access the capital I needed to accelerate growth and also introduced me to strategic partners who contributed their expertise and connections–which played a vital role in our success.” – Nancy Twine

What are the main advantages of seeking external funding?

1. You accelerate your growth potential

With access to a larger budget, you’ll be able to make larger investments to scale your business at a faster pace and move more rapidly toward your business goals.

2. You have access to a network of partners and their expertise

Investors bring in much more than just financial support: They have industry experience, valuable insights, and a network of helpful connections. By learning from my private-equity investor’s expertise and leveraging their connections, I was able to avoid many mistakes and do-overs when it came to scaling my business.

3. You take on less personal financial risk

With one or more investors sharing the financial burden of scaling your business, you can avoid, or decrease, your personal financial risks.

4. You can build credibility and brand visibility for your business

Your investor’s support will be a vote of confidence in your business. This might attract other investors and top hiring talent. Plus, your investors’ connections can increase your brand’s visibility, drawing in new customers.

External funding can be a great option if you need higher levels of capital to jumpstart your business, prefer to lower your personal financial risks, or want to access a larger network of partners and expertise. As with bootstrapping, however, seeking funding also comes with its own set of disadvantages.

What are the potential cons to seeking external funding?

1. You won’t be in complete control of your business

When you bring on investors, you agree to share decision-making powers, which usually means finding ways to compromise and share control.

2. Your ownership could be diluted

You may have a smaller stake in the business as a result of bringing on investors, meaning you’ll be sharing profits, too.

3. You may lose some privacy

Investors often request access to sensitive business information, which is a downside if you prefer more privacy.

4. You might face some pressure from your investors

Investors naturally expect a return on their investment, which may mean that you’ll have to deal with pressure and differing expectations about your business’ growth targets and timelines.

What to Remember as You Decide Whether to Bootstrap or Seek External Funding

As you carefully consider the pros and cons of bootstrapping versus seeking funding, keep your goals, resources, and risk tolerance in mind. Remember that bootstrapping empowers you with independence, control, and fewer financial obligations, while seeking funding unlocks access to capital, expertise, and accelerated growth potential. One approach involves limited initial capital and potentially slower growth, while the other involves sharing control and diluting ownership.

By assessing these pros and cons alongside your unique circumstances, needs, and objectives, you’ll help ensure your financial strategies align with your long-term vision. Remember, there is no one-size-fits-all approach: A combination of bootstrapping and seeking funding could be your best bet. Ultimately, the path you choose should empower you and align with your values as an entrepreneur.

Based on your unique situation, do you think bootstrapping, seeking funding, or a mix of both methods is the most beneficial approach? Share your thoughts in the comments!

I decided to go the bootstrapping route. In the beginning, I was just exploring an idea I had, so I started by investing a small inheritance I’d received. My idea did gain traction and I had formulas and packaging developed when in a twist of fate, my full time job (in the beauty industry) was eliminated, I knew it was time to jump in all the way. I really leaned into your experience developing Briogeo and it gave me courage to continue to invest my own savings into this project to see it through to completion.

I appreciate your pros and cons for each path of funding. I do love having more control over the initial conception of my brand and products, and I hope that when I do move into scaling and needing access to more capital, that some of the brand will be “baked into the cake”. I really do look forward to the day when I am not wearing all the hats and can hand off some things to more experienced people! Right now, I’m relying on freelancers and the kindness of my beauty industry friends and former colleagues for their advice in areas where I have no experience.