Managing money can be… intimidating. As a new or returning entrepreneur, finances can be especially daunting as you navigate the expenses, debt, and investments in your business and personal life.

Despite this, it’s important to remember that money is just a tool that yields unlimited power when used effectively. Learning how to manage money is the crucial first step in shifting your money mindset. To get you started, here’s a budgeting breakdown for a financial novice.

What is a Budget?

You can’t master what you don’t understand, so let’s begin with the basics. A budget is a financial plan that outlines an individual’s or organization’s expected income and expenses for a specified time. (You can budget for long-term items like holiday ad spend or special events like an upcoming solo trip.)

Generally speaking, budgets are an estimate of income and spending that helps people keep track of their habits and make informed decisions about their finances.

Why are Budgets Important?

Budgets are the macro and micro view of your finances. It maps out potential spending, creates opportunities for more abundance, and leaves a cushion for emergencies. If you want to manage your money effectively, tracking your income and expenses will allow you to identify areas where you can save money and set financial goals.

Budgets are also your best friend when it comes to mitigating overspending. (Absentmindedly swiping your card can cease with a set budget.) Many people are surprised by the debt accumulated over time because they are simply not paying attention. Budgets can give you peace of mind by providing a clear picture of your financial situation from all angles.

How to Budget for the First Time

Start by calculating your monthly income (include things like wages, affiliate revenue, side-hustle income, etc.) Transparency is essential. Be thorough with your numbers to ensure you have the clearest picture of your finances. This will ensure that you and/or an advisor can create a plan of growth and accountability. Your transparency is vulnerable, but your financial wellness depends on your ability and willingness to show up.

Next, list all your monthly bills and prioritize them by importance. (Rent, mortgage(s), utilities, credit card payments, etc., are typical, high-priority bills.) Once you have them listed, determine how much money you can allocate to each category of expenses, such as groceries, entertainment (going out and dining out), shopping and savings.

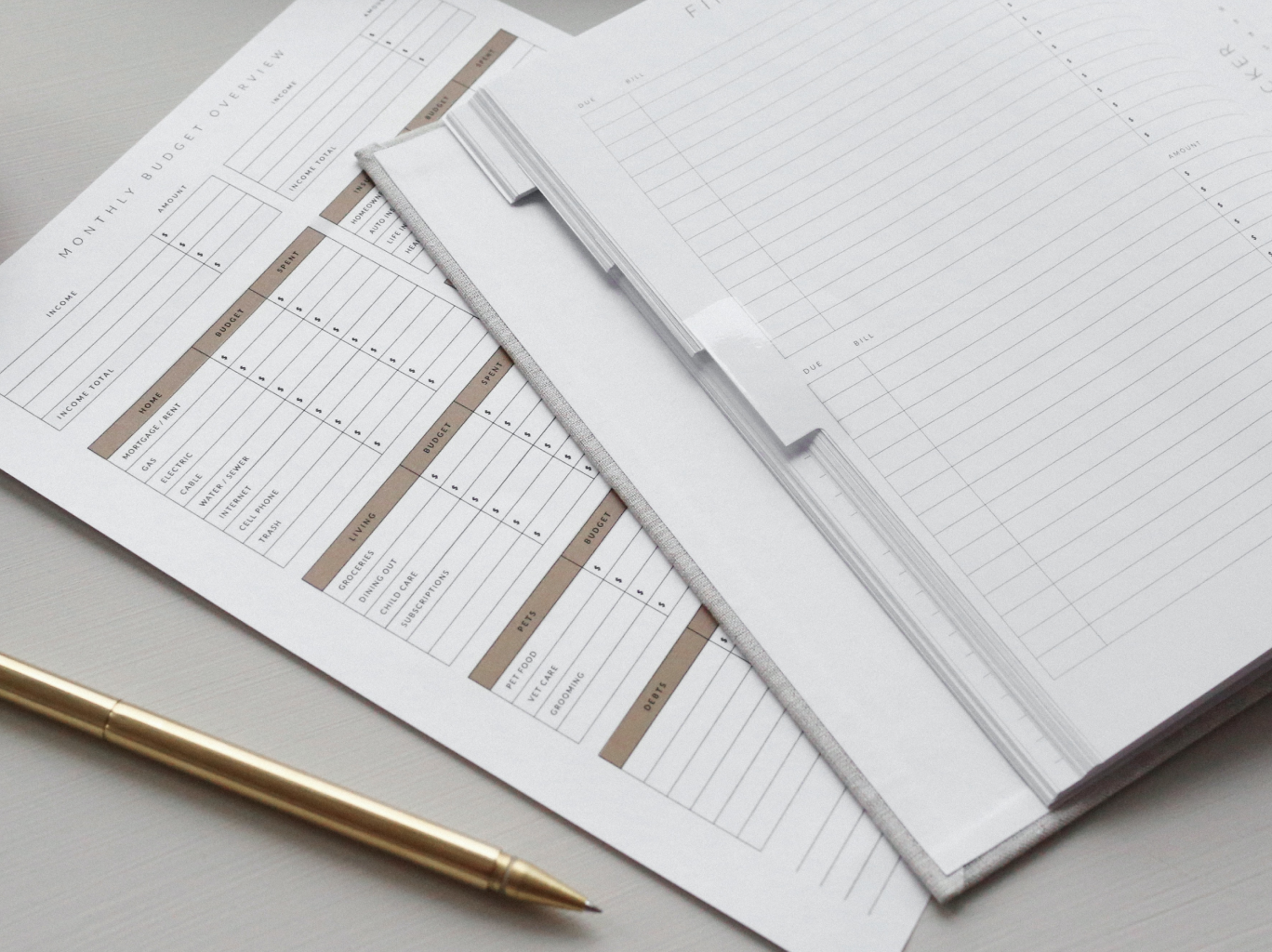

We’ve created a simple-to-use budgeting template to help guide you through the process of creating your budget.

Last but certainly not least, stick to your budget. This is your greatest challenge, especially in the beginning. While you have room to adjust it as necessary to achieve your financial goals, try not to sway from your budget plan. Consider using budgeting tools or apps to help you track your spending and stay on track. (For a digital tool, Mint comes highly recommended by financial sites.)

“Transparency is essential. Be thorough with your numbers to ensure you have the clearest picture of your finances.” – Nancy Twine

How to Stick to Your Budget as an Entrepreneur

Sticking with a budget is easier said than done, especially as a budding business owner. Here are some realistic tips to help you commit to your budget as an entrepreneur:

1. Set a clear and practical budget

Set a budget that considers all of your expenses. (Including bumps in the road, operational costs, professional development, and more.)

2. Keep track of your spending

Plus, regularly review your budget to ensure you’re staying on track. (Ideally, when you swipe your card, you check to make sure you’re within your spending window.)

3. To add to the previous point, entrepreneurs should track their business and personal expenses separately

We recommend Quickbooks Online for comprehensive, but user friendly, accounting software that can help you organize your real-time income and expenses. (Setting up a separate business bank account is ideal.) When filing taxes and accounting for expenses, having separate, well-tracked expenses will save you time and stress.

4. Prioritize your spending and focus on the most important expenses first

That means making the most of what you have, seeking readily available resources, and choosing efficiency over ego or convenience.

5. Look for ways to cut costs, such as negotiating with suppliers or using free or low-cost tools and support

Avoid impulse purchases and stick to your budget, even when unexpected expenses arise. Emergencies happen but think critically before stepping out of your budgetary bounds.

What Happens Next?

Download our free budgeting sheet to get started on your plan toward financial freedom:

Then, learn how to raise seed capital with Ask Nancy and browse through financial hubs like NerdWallet and Ellevest to dive deeper into financial planning.

Get grant opportunities, exclusive invites, tools, and entrepreneurial inspiration in your inbox once a month. Sign up for the Makers Mindset newsletter.